The Concept of Investing in Bridging Loans

European and global investors are looking for more innovative investment opportunities that are proven to add value to their portfolio. One such option is to invest in property-secured loans and one of the most favourable in recent years is the UK bridging finance lending market for business purposes.

Due to the short term nature of investments in bridging loans, investors can not only draw a regular income, but also benefit from a clear exit strategy as the loans are paid off in full usually within six to twelve months. Borrowers often need the funds to purchase mainly London property to develop and sell on for a profit, or use as a longer term buy to let. Either way, bridging finance fills the gap where major financial institutional lenders aren’t geared to provide funding quickly for renovation projects or conversions which maximise planning yields.

Our short-term (bridge) loans seek to capitalise on this demand and provide an advantageous return for investors.

The Strategic Investment Objectives

Operating within this buoyant niche lending sector, our aim is provide high returns and solid collaterals such as well-located and rented residential and commercial property in London as security for the loans we give out. As the lending to clients is over a short period of time returns can be quickly realised and exposure minimised, as the value of the properties (LTVs) used as security is significantly higher the investment amount. These benefits are proving to be attractive to investors looking to diversify their portfolio in an informed and constructive way.

Contracts and documentation are totally transparent with the protection of the UK legal system.

Asset Location and Development

With London being one of the most prominent cities worldwide to live and own property, the bridging sector is well served with opportunities to improve or develop dwellings for the rental and buyer sectors.

Rents in London have now climbed to an average of £2,000 per month, a three year high. This shows that good returns can be made for investors that are tuned in to the opportunities of funding landlords and property professionals to acquire rental property for letting purposes.

The Scale of the UK Bridging Market

The Association of Short Term Lenders (ASTL) compile regular lending figures from members that are most of the key players in the bridging finance sector.

Annual completions continue to rise and are now £3.87 billion. On Q1 this year the annual completions rose by 27.2% and the value of loans written in the quarter has increased by 10.3% compared to the year ended 30 June 2017.

Total lender loan books are continuing to climb, with a rise of 13.1% compared to Q4 2017 and are now over £4.2 billion.

The upward trends in the bridging market are also highlighted by Bridging Trends, who monitor and report on the figures of seven key players in the bridging sector.

With an average LTV at just 56.9% there is sufficient equity in the lending and with an average loan term at just 11 months, it is evident that the loans are fully repaid in a short period of time. These parametres provide confidence to investors as they indicate that their short-term investment is in a vibrant property market, thus and give an enhanced degree of certainty that other investment funds are not able to match.

Conclusion

Bridging finance is rapidly becoming the acceptable way to provide capital solutions to individuals and private companies currently underserved by traditional lenders. These direct lending opportunities typically offer the potential for above-market, risk-adjusted returns to high net worth individuals and professional investors globally.

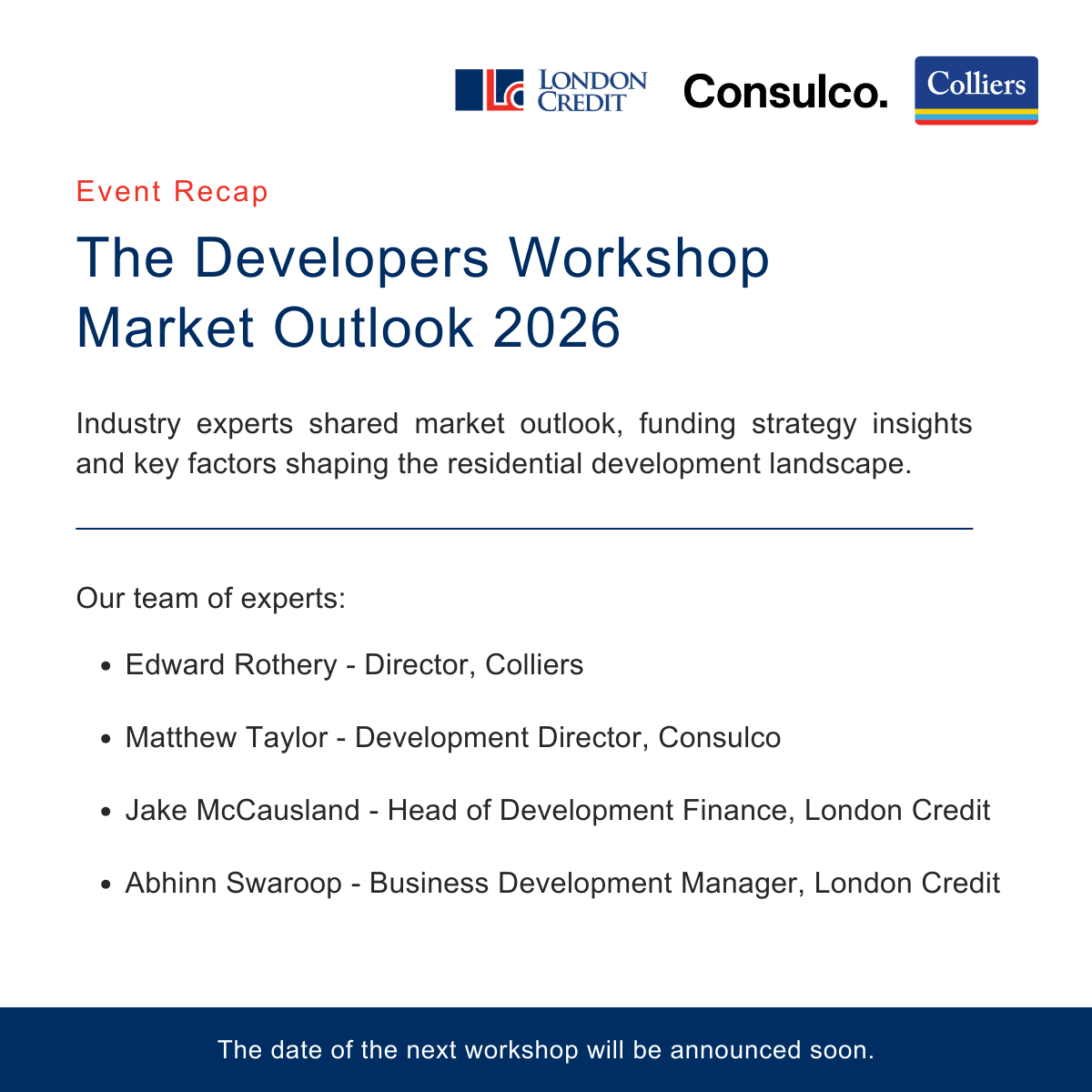

The Consulco Group has seized this opportunity and through its London-based lender trading under the brand London Credit, has been providing bridging loans for over 7 years, and offers them as a fixed-income investment product to investors from all around the world.

It has built a strong track record, and has been consistently delivering high returns to its clients, who at maturity of their investments most frequently elect to reinvest in new loans from the loan portfolio.

For more information please contact us at info@consulcocapital.com or visit either of our websites at www.consulcocapital.com or www.londoncredit.com

Disclaimer: Although investments are secured against property, your capital is at risk.

You are cautioned to make your own independent decision based on your own judgment and/or consult your advisors on the merits of the course of action you are considering taking, after evaluating all the risks in conjunction with your financial situation and needs.

Consulco Capital Ltd (ex Capitalman Ltd) Licensed Fund Manager AIFM05/56/2013.